What is Reconciliation?

Definition of reconcile. transitive verb.

1a : to restore to friendship or harmony reconciled the factions.

b : settle, resolve reconcile differences.

2 : to make consistent or congruous reconcile an ideal with reality.

Reconciliation is a means of comparing two financial records with each other, one being the transactions and account balances in Simple Budget, and the other being your bank statement and balances. It is important to know that they match up and it is essential to help find errors, false charges, and discrepancies. Comparing Simple Budget transactions and account balances with the bank’s also helps to prevent spending more than your account has to spend.

Reconciliation occurs at a certain point in time. That is, we will compare the current balances of Simple Budget with your banks statement at the same point in time. You don’t compare your Simple Budget balance of today, with the bank statement of last week, or of tomorrow.

Reconciliation in Simple Budet

Simple Budget has a built in process that will help balance itself against your bank account. Here is how it is done:

- When you decide to reconcile your budget transactions, print out your bank statement with a detail list of the transactions up to that moment in time.

- Have all of your transactions up to date in Simple Budget.

- In Simple Budget, go the the “Reconcile Transactions” form by clicking on “Transactions” on the Home Page menu, then click on “Reconcile Transactions” sub-menu.

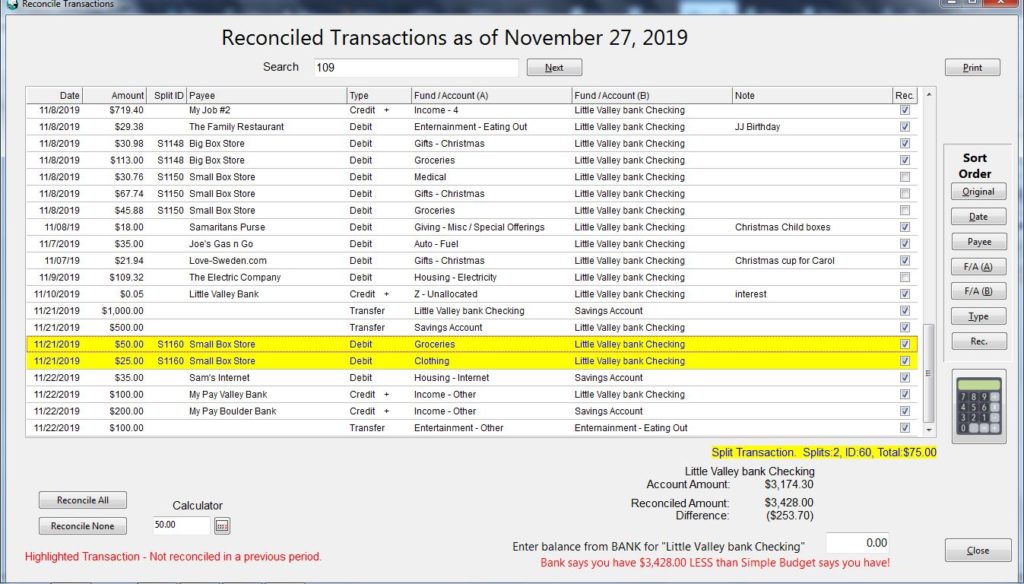

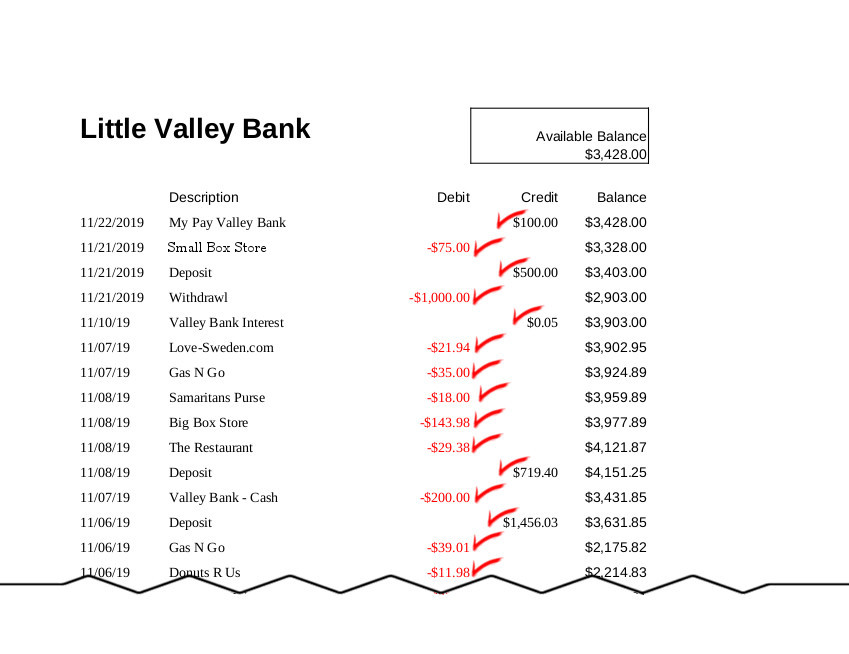

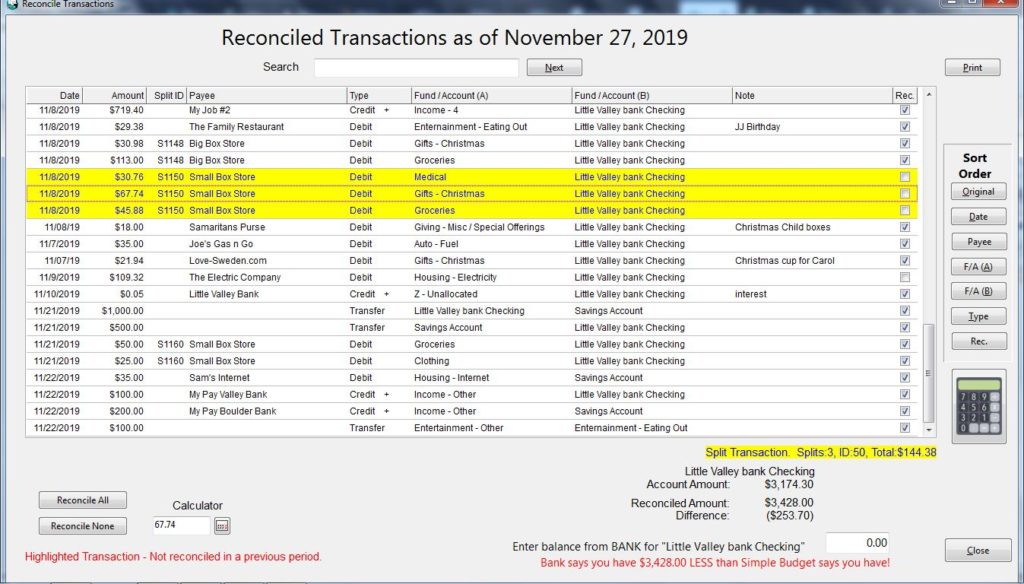

- The Reconcile Transactions window should open as show below:

- Using your bank statement, check off each transaction one a time as you find it in Simple Budget (Picture 1) using the check boxes at the right edge of the transaction row, and check it off on the statement also as shown below in a portion of a (Picture 2) fake bank statement made for the above fake (Picture 1) Simple Budget transactions.

- Notice on the Simple Budget – Reconcile Transactions picture above (Picture 1), that the yellow highlighted transactions are parts of a “Split” transaction. Whenever a transaction is selected in Simple Budget and it is part of a “Split” transaction, all parts of the split are highlighted and the total of the split along with the number of splits is highlighted below the list of transactions. In this case, the Split transactions are for the Payee “Small Box Store” with a total of this Split transactions is $75.00. Find the transaction for “Small Box Store” totaling $75.00 on the above bank statement (Picture 2). When reconciling a Split transaction, each part of the split must be checked off in Simple Budget.

- Near the bottom right of the Reconcile Transactions window (Picture 1) there is information about the Account, Reconciled Transactions, and the Difference.

– Current selected Bank Account name

– Account total in Simple Budget

– Reconciled Amount (checked Income – (minus) Expenses)

– Difference (The total of Unchecked transactions)

– An entry spot for the current bank balance according to the bank statement

– A message about the total comparison between Simple Budget and your bank.

- Notice in Picture 1, that there are two transactions that were not reconciled. That means that the bank does not yet know about them. That can occur often when checks are written as it takes time for the check to be cleared at the bank. This can also occur if you recorded an automatic withdrawal before the actual time the bank makes the payment. It can also occur in everyday use of a debit card as when you order a product online and your account may not be charged until it the item is shipped. *** It is IMPORTANT to note that you can not rely on the balance the bank says it has if you run your account down to zero, because as soon as those un-reconciled items clear the bank, you will have an overdraft. *** The bank thinks you have more money than you do. Simple Budget tells the actual amount you have in your account, if there are no errors.

- Also note in Picture 1, that one of the transactions that has not been reconciled is a “Split” transaction. If a row of one of splits is selected, the total split will be highlighted and the total of the split is shown below the list of transactions. See Picture 3 below.

- The total of the Un-Reconciled split transaction is $144.38. The total of the other Un-Reconciled transaction in our example is $109.32. The sum of those transactions is $253.70. The amount is shown as “negative” because expenses really “negative” numbers. They “reduce” the amount in an account. That is exactly the amount for the “Difference” shown in all of the pictures of the Reconcile Transactions window.

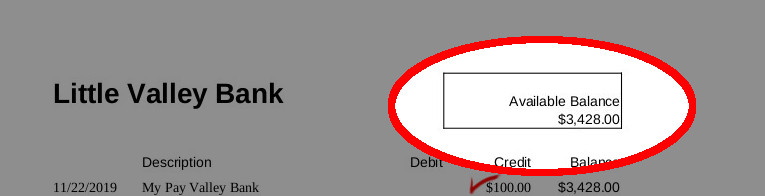

The final part of the reconciliation process is to tell Simple Budget how much the bank thinks it has. Look at Picture 4 below. It is a portion of the top of our fake bank statement (Picture 2) with the “Available Balance” highlighted. The fake bank thinks it has $3,428.00 available. That is wrong of course because there are $253.70 worth of outstanding transactions that might come into the bank at any time. Simple Budget helps you resolve those differences.

- Take the amount the bank says is available: $3428.00

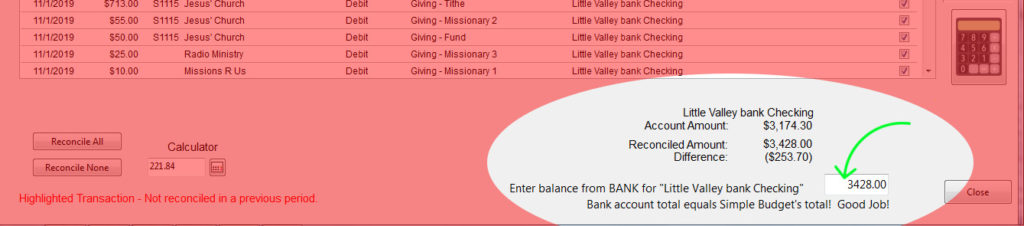

- Enter that amount into Simple Budget at the spot shown in Picture 5 below. Do not enter the “$” or any commas “,”. Press “Enter”

- Simple Budget will compare that amount with what Simple Budget thinks the bank should have. If there are no errors, Simple Budget will say:

“Bank Account total equals Simple Budget’s total! Good Job!” (Picture 5)

If your bank account does not equal Simple Budget’s total, then Simple Budget will display an error message telling you the difference and whether the bank thinks it has “more” or “less” than Simple Budget thinks it has. Here are some tips if the two totals don’t agree:

- Double check your bank statement transaction amounts against Simple Budget. It is possible that you entered a wrong value, or maybe the bank did. If the bank has a wrong value, you will have to contact the bank to correct the error.

- Look at the difference that Simple Budget is reporting between itself and the bank. Look for a transaction on the bank statement, or in Simple Budget for a transaction with that amount. Could you have missed entering a transaction into Simple Budget? If you are just starting a spending plan (budget) for the firs time, you may not be in the habit of keep track of every single purchase. Every single purchase and income MUST be recorded in Simple Budget. It takes discipline, but is well worth it when you master your finances instead of having them be master over you.

- Are the check boxes in the “Rec” column in Simple Budget checked when they are supposed to be and unchecked when they are supposed to be? Double check to make sure only the items that the bank does not know about are “Un-Checked”. You can sort the transactions by their reconciliation “Status” by clicking the “Rec” button in the “Sort” panel. This will group all of the “Unreconciled” transactions together so you can see them all.

- Look through your transactions (in Simple Budget, and on your bank statement) for the exact amount you are off. Sometimes, that will help point you to a transaction you missed somewhere.

If this is the first time you have reconciled your transactions and if you can not find the difference between the bank and Simple Budget, I would recommend on leaving the error as it shows for a few months. Reconcile your transactions often so they don’t get out of hand and confusing. After a couple of months, if that “Difference” stays exactly the same, make an adjustment transaction in Simple Budget to balance Simple Budget with the Bank. For example, lets say the Simple Budget has been telling you for three months that the bank has $20.59 more than Simple Budget thinks it should have. Enter an “Income” transaction” in Simple Budget for $20.59. Choose a fund of your liking, and make a comment in the “Note” section that this is a dummy transaction to balance between Simple Budget and the Bank. If errors occur often, you may need to look at your procedures. Something is being done wrong.

Other Thoughts…

- Simple Budget makes reconciliation an easier job. Do it often so it doesn’t get out of hand. It is easier to find a few “current” transactions on the bank statement than trying to find a particular transaction in pages of transactions.

- Look at the options you bank may have to print the statement. Often times, the bank will have an option to print only those transactions that are new since the last time you printed it. That way you don’t have to wade though lots of old transactions trying to figure out where they are at in Simple Budget and have they been reconciled yet.

- Fund Transfers will not show up in the bank statement. They are for your own use in managing you spending categories. Simple Budget allows you to reconcile and un-reconcile your fund transfer transactions. Usually, you want to “Check” them so they are reconciled, otherwise, they will be carried over from month to month.

- Account Transfers in Simple Budget might actually be real transactions in the bank statement. If you transferred money from Account X to Account Y in Simple Budget, the bank statement for Account X will show a withdrawal and Account Y will show a deposit since you would have to do an actual bank transaction to transfer the money. It is possible in Simple Budget to have “Fake” Accounts to help you separate your money out without actually having separate bank accounts. In that case, the Account Transfer would not show up on the bank statement and you should mark it “Reconciled” in Simple Budget.

- Notice on the example used on this page, there is a 5 cent interest income. Many times I don’t know about that until I print out the “Bank Statement”. If you see a transaction that the bank statement has but is NOT in Simple Budget, enter that transaction into Simple Budget and then continue with the reconciliation process. If it is from a purchase or deposit you made, but forgot about, you need to keep track of your transactions better.

- Enter ALL of your spending and income into Simple Budget. Do NOT rely on your banking app to tell you how much money is in your account. You WILL get caught! Be the MASTER over your money. DON’T let it be master over you. In this age of instant everything, more and more people are relying on the bank app to run their finances. You will come up short doing that. Break that BAD habit.