Changing Budget Amounts:

Budget amounts are simply amounts that you have decided that you can spend in each category (fund), and the amounts of income you expect to receive in one month.

The proper Funds need to be created first. See more information about Funds HERE. Strictly speaking, you do not need an Account to set the budget amounts, but at least one Account will be needed to use Simple Budget. Find for information about Accounts HERE. The following is worth repeating here:

Cash / Budget Relationship:

Both are needed to release cash from an account. The account holds the cash and the budget gives you permission to spend it. BOTH are required. You can not spend cash permitted by a budget if your account does not have the cash. You can not spend the cash in your account if your budget does not give you permission to spend it.

If you have not prepared your Budget Amounts, I suggest you read the Getting Started page HERE to help calculate your Budget Amounts.

Now that Fund and Accounts are created, it is time to set the “Budget”. Under the “Budget” menu select the “Budget Amounts” sub menu. Start by entering your “Monthly” income funds (Your total projected income for the month). This is the maximum that you can spend in the month. That is the idea of having a budget, to manage your spending.

At the bottom of the window, it will say that the budget is “Not Balanced” and show how much is available for all the funds. The purpose of Simple Budget is to help you manage your spending and will not let you set up budget amounts that total more than your income for the month. Go to your worksheet that you have already filled out in the Getting Started page, with your actual spending amounts. Add up the total that you spent. If that amount is more than your calculated income, you need to make some decisions as to where you can cut your expenses, or increase income. As I mentioned before, for me, the big money waster was in the “Eating Out” category.

Again, here is a helpful resource. I have no connection to them, they are just good!

– Compass

– The Compass Map is can be gotten HERE, for a road plan to financial freedom.

As you start entering each fund’s budget, the amount available shown at the bottom of the window, will change to show how much money is left for the rest of the funds. You may have to compromise on “unnecessary” funds and “tighten your belt” as you live within your means. Once all the budgets are entered, you will have to “fudge” a fund or two to get the budget exactly “Balanced”. It MUST be balanced or you will not be able to enter transactions. In my personal budget, I created a fund called “Z-Unallocated” for the amount left that I didn’t need to budget for. I began it with a “Z” so it will be sorted at the bottom of the list. If you create such a fund, you can then use the money in that fund to put into savings, or reduce debt, or for a special project.

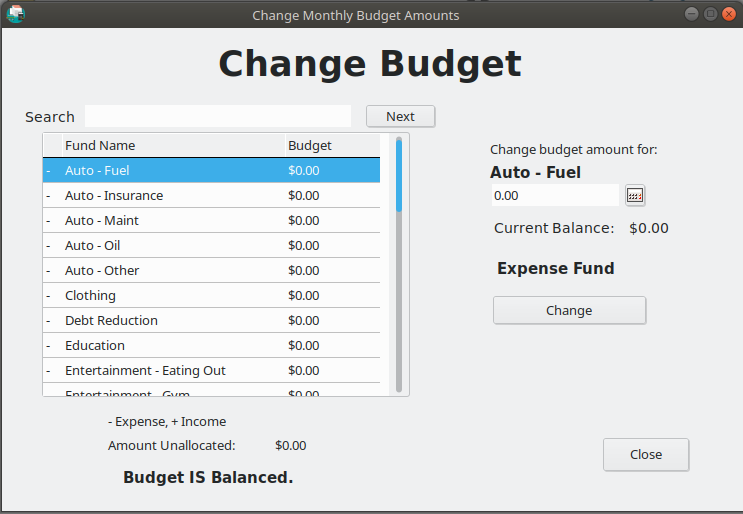

Changing Budget Amounts

Changing the budget amounts of the funds is easy. Under the “Budget” menu, select “Budget Amounts”. This is most easily accomplished if you have a list of the funds with the amounts that you have decided to give them. Click on a fund name, click on the Edit box, or press “Tab” to move there. This will automatically highlight the value so it can be easily entered. Clicking on the small calculator icon next to the edit box, will open a small calculator that you can use if needed. Press OK and the value will be entered into the edit box. Only numbers, and period (Decimal Point) are allowed to be entered. Press the “Enter” key on the keyboard or click the “Change” button. When the budget is “Balanced” it will be indicated at the bottom of the window. The budget is balanced when all “Expense” funds equal all “Income” funds. It is suggested that you enter your income first, then assign the expense funds values. The amount “unallocated” is also indicated at the bottom of the window. The budget MUST be balanced before any transactions can be entered.