The “Transfer” type of transaction is used when you want to take some money from one “fund” and put it into another “fund”, or if you want to take some money out of one bank account and put it into another bank account. Both types of “transfers” are easy to record in Simple Budget.

Funds Transfer

A “Funds Transfer” is when you take designated money from one fund in your budget and give it to a different fund. The amount of money in your bank account doesn’t change, but the amount you want in certain spending categories does change.

Here is an example of why you might transfer money from one fund to another fund. Let’s say you have a “Slush Fund” that helps you save a bit of money away for a rainy day. And, also, let’s say you have an “Auto – Maint” fund that you keep for your car maintenance needs. If your budget is set up properly and you have your priorities in line, you will be putting some money each month into your “Auto – Maint” fund for those maintenance needs. But, let’s say your car had unexpected expensive repairs that you weren’t anticipating, but you had some excess money in your “Slush Fund”. Understanding that you will need to reduce your spending from your “Slush Fund”, you decided that $200 from it can be used to supplement the “Auto – Maint” fund. So, in a way, you are taking $200 out of your “Slush Fund” and putting it into your “Auto – Maint” fund and your budget won’t be busted. Here is how you do it.

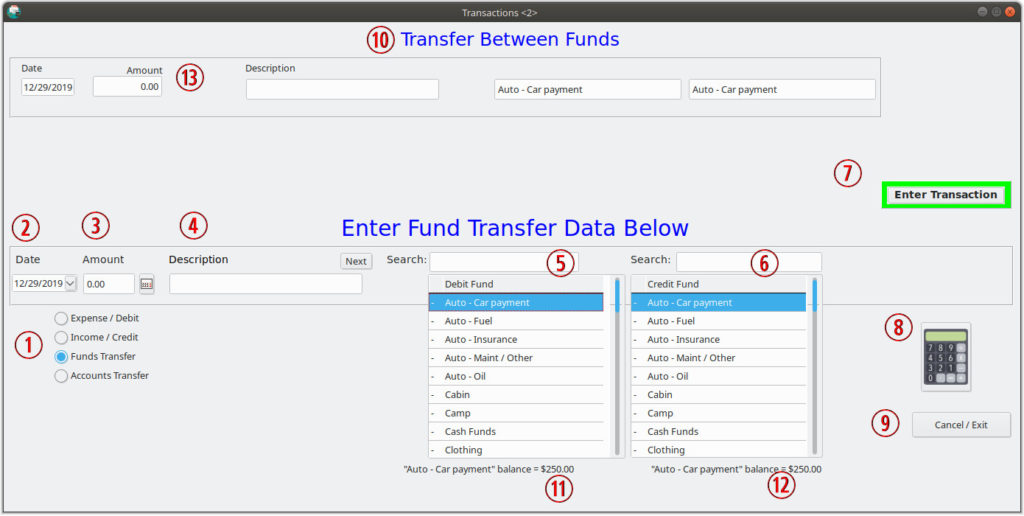

The Transfer form is divided into two areas. The upper portion of the form shows what information you have entered into the form that will be saved when you “Enter” the transaction.

The lower portion of the form is where you select the information about the transfer transaction. As you select the information, it will be shown in the upper portion of the form for your verification before it is “Entered”.

- First, go to your “Transactions” form by selecting “Transaction” in the main Simple Budget menu, then select “Transactions/Transfers” below that.

- The form will not look quite like the one pictured above – yet.

- The first thing you must do to enter a “Funds Transfer” is to select the “Funds Transfer” radio button shown in the picture at (1). As soon as you click the button, the form will change to look like the picture above. Note that the label at (10) will now say “Transfer Between Funds”.

- Enter the date by clicking the small triangle pull down button at (2). A small calendar will pop up, and select the transaction date.

- Enter the amount you want to transfer from one fund to another in the “Amount” entry boxe at (3). There is a small calculator icon next to the entry box that can be opened and used if needed.

- If you want to enter a small note so you can remember what this transfer is about you can enter in into the “Description” box at (4).

- Select the Fund you want to transfer FROM from the list labeled “Debit Fund” (lower (5)). Note that as you select the fund, the current balance of that fund is displayed below the list (11). Also, notice that as you select the fund, it will automatically show up in the upper area of the form. (13)

- At the right hand list of funds marked “Credit Fund” (6), select the fund where you want the designated money to be transferred TO. Also, note that the same fund will automatically be displayed in the upper part of the form at (13). And, see at (12), the balance of the fund that you want to transfer the money into.

- When everything is entered properly, press the “Enter Transaction” button (7). If there are any errors, the transaction will not be saved. Correct the errors and try again. When the transaction is successful, pop-ups will show that the transaction was completed.

- If you are done transferring money from one fund to another, you can click the “Cancel/Exit” button (9) or click the “X” on the form frame to close the form.

Accounts Transfer

Accounts Transfers are very similar to the Funds Transfers as described above. There are several reasons why you might transfer money from one bank account to another. Let’s say you are saving for vacation and having the money that is collecting in your budget for vacation might be less tempting to spend if it was in a different bank account. Or maybe you have a “Long Term Savings” fund and you place that money into a savings account that might have higher interest. To make an “Accounts Transfer” first read about Funds Transfers above, then continue.

To transfer money from one account to another in Simple Budget do the following.

- First, you need to actually take money out of one bank account and put it into another bank account.

- Then, in the Transactions form of Simple Budget, click the “Accounts Transfer” radio button at (1). The form will change and the label at (10) will say “Transfer Between Accounts”.

- Enter the Transaction Date (2), Amount (3), and a note if desired (4) as in the Funds Transfer.

- Select the Debit Account at (5) where the money was withdrawn (taken out of) from. Notice the label below the account list (11) shows the current balance that Simple Budget believes is in your account.

- Select the Credit Account at (6) where the money was deposited into. And, like the step above, notice the label below the account list (12) shows the current balance that Simple Budget believes is in that account.

- If all is ok, then press “Enter Transaction” to transfer the money in Simple Budget. If there are any errors, the transaction will not complete. Fix any errors and try again. When Simple Budget is successful, pop-ups will show that the transaction is complete.

- If you are done with transactions, you can close the form by clicking the “Cancel/Exit” button at (9) or by clicking the “X” in the window frame.

Account Transfers can also be done within “Transactions”. If both of your accounts are at the same bank, you might be able to do an actual “Accounts Transfer” at the bank, but if you are taking money from one bank account and depositing it into anther account at a different bank, you would, in reality, make a withdrawal transaction from one bank and make a deposit transaction into another bank. The effect would be the same in Simple Budget, except in the withdrawal and deposit transactions, you would have to select a “Fund” to withdraw from, and then to deposit to. The Fund balance would remain the same between the two transactions, and the Account balances would differ by the amount of the transactions.

To learn about Entering Transactions, Editing Transactions, or Deleting Transactions, go to the pages listed below:

Expense, Income & Split Transactions

Edit Transaction

Delete Transaction

For information on how to Reconcile Transactions, look HERE.