Simple Budget operates on “Monthly” periods. The “Budget” amounts for each Fund is based on a month. There are 12 Simple Budget periods in a year. If you have expenses or income that are not based on a month, calculate how much that expense or income is for a whole year, and then divide that amount by 12 to figure what the “Monthly” budget should be. And, since Simple Budget operates on “Monthly” periods, ALL transactions made in a single month should be entered into Simple Budget for that month before adding a “New Period”.

There are two kinds of periods in Simple Budget. Monthly and Yearly.

Steps to “get ready” for a new period in Simple Budget.

- Simple Budget will not initialize a new period until you tell it to.

- You can not initialize a period before the current month is over.

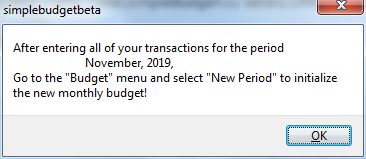

- After the end of the month, Simple Budget will remind you every time it is opened that a new period needs to be initialized.

- All transactions for the month must be entered.

- Print out your bank statement and reconcile all transactions that can be reconciled.

- Fix any problems before initializing the new period.

- Look at “Reports” and “Graphs”. Print or save reports (as pdf’s) for your records (as you see fit).

- Make decisions based on your reports and graphs.

- Initialize a “New Period”.

What happens when a “New Period” is initialized?

New Month

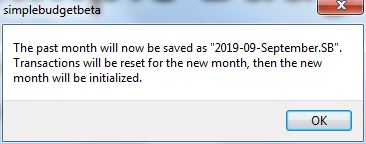

- The current month is saved and archived in it’s own file. An “archived” Simple Budget file can not be changed but can be viewed. The name of the file is like: 2019-09-October.SB. These files are used in the YTD Fund Detail Report and can also be opened and viewed at any time.

- For each fund, the ending balance of the current month becomes the starting balance of the new month.

- The Monthly “Starting” amount for each fund is updated by adding the “Budgeted” amount to that fund.

- For each account, the ending balance of the current month becomes the starting balance of the new month.

- All of the transactions for the month are “purged” (deleted) EXCEPT those that have not been reconciled. The “Un”reconciled transactions are carried over from month to month so you can “reconcile” your budget properly. (All of the transactions are preserved in the archived file.)

- All expenses and income for the month are set to zero.

- The “New” month is initialized and saved in the file “CURRENT.SB”.

New Year

- All of the steps that are taken for a “New Month” are also done for a “New Year”.

- Additionally , the “Year Start” balances for each fund are set from the previous month’s ending balances.

Initializing a “New Period”

A new month can not be initialized until after the old one is over. The next time Simple Budget is opened, it will display a notice that a “New Period” needs to be initialized.

- Simple Budget knows if a new month or a new year needs to be initialized and won’t do the wrong one by accident.

- You can continue to use Simple Budget as normal. Every time you open Simple Budget, it will display the above reminder (Picture 1) until you initialize the new month.

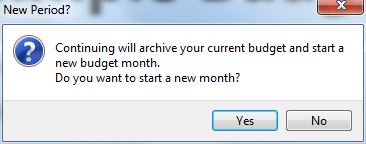

After all of the transactions for the period are entered into Simple Budget, and they are reconciled to date, go to the “Budget” menu and select “New Period” to initialize the new month. The following notice will be shown.

If you choose to continue the “New Period” process, click “Yes”. If you did click “Yes”, the following dialog will be displayed.

Press “OK” and a “Save File” dialog will be displayed to save the past month as shown in the previous dialog (Picture 3). Click “Save” to save the archived monthly file.

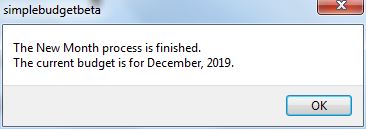

If the new month initialization is successful, the following dialog will be shown.

If an error occurred in the “New Period” process, Simple Budget will notify you and the new month will not be initialized.

Note:

(starting with Simple Budget version 2.1.6, the following paragraph is no longer true. With the release of 2.1.6, Simple Budget will advance 1 month each time the “New Period” is run and will automatically detect when it is time to run the “New Year” portion of the “New Period” process. This way, if you are behind in entering your transactions by more than one month, you can “Catch Up”. It is not a good idea to get behind, however, because Simple Budget is a tool to help you in your spending plan. If is not up to date, you are defeating the purpose of Simple Budget, and it may cause complications trying to get caught up to date.)

As of version 2.1.6, the following is no longer true.

Simple Budget is meant to be used continually throughout the periods. (Yes, that is still true) By disciplining yourself to pay attention to your spending, Simple Budget will help you to stay on track. Notice the dialogs above that the “current” month was “September 2019” and the “New” month is “December 2019”. October and November were skipped. The reason for this is that I used files that I am testing in the development of Simple Budget, but if you neglect your finances for a long time, Simple Budget will initialize to the “current” month, no matter what the previous one was. You will not have the correct “current” budget amounts for the new month and the budget will be “broken“.