Simple Budget operates like you do. It tries to stay away from “accountant” speak, though a little is necessary to get the job done.

Simple Budget operates like you do. It tries to stay away from “accountant” speak, though a little is necessary to get the job done.

When Simple Budget is started, you will be greeted by the window shown at the left. After a few seconds, that will disappear , or if you are like me and want it to go away, click on it or hit “enter”.

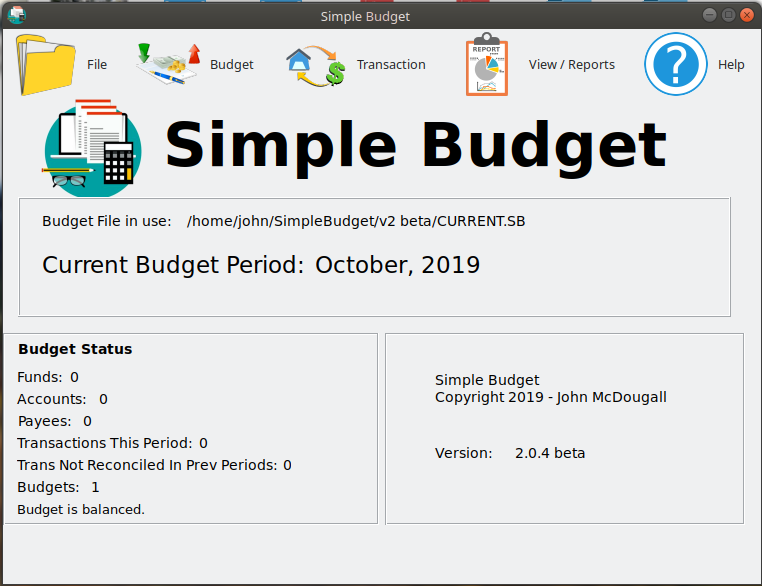

You will then be greeted by the main “control panel” of Simple Budget. Here, you will see a snapshot of information and the menus to go where you need to go.

Some of the things you will notice at a glance are:

- The path to your data file. Your data file is called “CURRENT.SB” and you will see where it is stored on your computer.

- Current Budget Period. This is the month that Simple Budget is operating in, and you should only put that month’s data into Simple Budget.

- Budget Status. Displays useful information about your budget like:

- Funds. How many funds are defined in Simple Budget.

- Accounts. How many accounts are defined in Simple Budget.

- Payees. How many Payees are defined in Simple Budget.

- Transactions This Period. How many transactions you have entered for this period.

- Trans Not Reconciled In Prev Periods. How many transactions are left over from previous periods that have not be reconciled.

- Number of Budgets. Only one budget is allowed at this time in Simple Budget.

- Balanced Budget. This indicates whether or not your budget is balanced. Since the goal of Simple Budget is to live within your means, you can not enter transactions before the budget is balanced.

If you are unsure of any of these terms, that is ok. We will go over them one by one and you will be on your way to using Simple Budget to help you live within your means.

The Menus

At the top of the Simple Budget main window are several drop down menus.

Under File – “New (Start Over)”, “Open”, “Save”, “Save As”, “Quit – Do Not Save”, and “Save and Exit”.

Under Budget – “Budget Amounts”, “Funds”, “Accounts”, “Payees”, “New Month”, and “New Year”. (as of Version 2.1.6, Simple Budget has one menu “New Period” instead of “New Month” & “New Year”.

Under Transactions – “Transactions/Transfers”, “Edit Transaction”, “Delete Transaction”, and “Reconcile Transactions”.

Under View / Reports – “View Fund Balances”, “View Fund Details”, “View Budget Amounts”, “View Account Balances”, “View Payees and Funds”, “View all Transactions”, “Transactions for One Fund”, “Transactions for One Account”, “View Funds Year To Date”, and “Trans Unreconciled From Prev Periods”.

Help – Some basic information about the different options and operations of Simple Budget.

Definitions: What do those things mean?

Here are simple definitions of some of the terms we will use as listed above:

Fund – A Fund is simply a category of your spending. Simple Budget will help you divide your spending into different categories with a budget (a monthly dollar amount) attached to each one. Think of the budget amount of a fund as being a “permission” to spend the amount, or less, of cash that you agreed upon with yourself. When you make a purchase, you designate what category (Fund) it should be taken out of so you can keep track of all the different types of spending you do. Here are a few examples of Funds: “Auto – Fuel”, “Auto – Insurance”, “Entertainment – Eating Out”, “Housing – Internet”, “Housing – Rent”, “My Income 1”, etc. There are two types of funds: Expense Funds and Income Funds. Expense Funds are for those things you pay for. Income Funds are where you put you money when you receive it, like a paycheck. At least one fund is required for Simple Budget, but in reality, you want to split up your spending and income into several categories (funds).

Cash – Money in the bank. Not credit. It does not necessarily mean coins and bills, but real money and not a loan or credit.

Account – An Account in Simple Budget is usually an actual bank account. It is where you keep your “Cash”. You can have several accounts. Lets say your main account is “Bank of USA”. You can call it what ever you like, like “Bank of USA – Main”. Then if you have another account to help you put aside money you don’t want to spend each month, you can call it “First Local Bank – Savings”. You can name them anything you want. At least one Account is required in Simple Budget.

Payees – A Payee is someone or a business that you pay when you buy something. For example, let’s say your store name is “Food N Go”, and you usually buy groceries there. You can have a Payee named Food N Go. Also, with Payees, you can attach a default Fund to them. So, you can attach a Fund called “Groceries” to the Payee “Food N Go”. This simplifies entering your spending transactions. The attached Fund is only the default, and you can use another one anytime on the fly, or you don’t have to have a Fund attached to the Payee at all.

Transactions – Transactions are the way of entering any transfer of money from one thing to another thing. Like you payed $45 to Food N Go for Groceries. You got your paycheck and you put it in the “Bank of USA”. There are four types of Transactions:

Expense Transaction – Your normal day to day spending, paying your bills, whenever you give cash out of your account.

Income Transaction – Normally when you deposit cash into your account from money you received somewhere like a paycheck.

Fund Transfer – You use “Fund Transfer” when you want to move money around in your budget. Be careful not to get in the habit of doing this a lot as you can bypass the purpose of the budget in managing your spending in each Fund you have set up. An example of Fund Transfer is let’s say you you have an unexpected auto repair that short you in your “Auto – Maint” fund by $100, but you have an extra $100 in your “Fun Money” fund. You can make a Transfer in Simple Budget and take that $100 from your “Fun Money” fund and put it into your “Auto – Maint” fund. If this happens often, you may need to look at your budget and have more available in your “Auto – Maint” fund and less in your “Fun Money” fund. We will look at setting the “Budget Amounts” later.

Account Transfer – An account transfer happens when you actually take money out of one bank account and place it into another bank account. Simple Budget is very useful in helping you save from month to month for certain spending goals. As an example, let’s say you want to set aside $100 each month for Christmas so you don’t have to come up with a boat load of money, or use the charge card at Christmas time. You can move that money out of your main account so you are not as tempted to spend it by placing it into another bank account. Then when you do your Christmas spending you can move it back to your main account.

Budget – A Budget is simply “A Spending Plan”. A Budget is a “Permission Slip”. It is the amount of “cash” (not credit) that you have given yourself permission to spend from a particular “fund“. Don’t be afraid of the word “budget”! Once you are on a budget for a while, it is freedom to know you have the money set aside for certain things. It helps you make decisions like, “Do we really need to go out to eat tonight, or not”. If we budget it, and you want to, then go for it. Later, we will talk about the actual budget process. You will assign each of your Funds a portion of you monthly income, and your goal is to not spend more than that amount you set aside in each Fund (spending category).

Cash / Budget Relationship:

Both are needed to release cash from an account. The account holds the cash and the budget gives you permission to spend it. BOTH are required. You can not spend cash permitted by a budget if your account does not have the cash. You can not spend the cash in your account if your budget does not give you permission to spend it.

You can find Simple Budget at the Ubuntu Snap Store for Linux operating systems, or at GitHub for Windows operating systems.

Want to get started with Simple Budget? Let’s go!